In today's volatile financial markets, creating a diversified fund portfolio is crucial for managing risk while maximizing returns. Whether you're a beginner or an experienced investor, understanding the principles of diversification can significantly enhance your investment strategy. This article dives deep into the concept of diversified fund portfolios, offering actionable insights and expert advice to help you build a robust financial foundation.

A diversified fund portfolio refers to spreading investments across various asset classes, sectors, and geographies to reduce exposure to any single risk. This approach aims to balance potential gains with manageable risks, making it a cornerstone of modern portfolio theory.

Throughout this article, we will explore the benefits of diversification, provide practical tips for constructing a diversified portfolio, and highlight common pitfalls to avoid. By the end, you'll have a clear understanding of how to tailor a diversified fund portfolio that aligns with your financial goals and risk tolerance.

Read also:Who Is Jesse Watters Exwife Unveiling The Story Behind The Headlines

Table of Contents

- What is a Diversified Fund Portfolio?

- The Importance of Diversification

- Asset Allocation in Diversified Portfolios

- Types of Funds to Include

- Steps to Build a Diversified Fund Portfolio

- Risk Management Strategies

- Measuring Portfolio Performance

- Common Mistakes to Avoid

- Expert Advice for Investors

- Conclusion

What is a Diversified Fund Portfolio?

A diversified fund portfolio is an investment strategy that involves spreading capital across different types of assets, sectors, and geographic regions. The primary goal of diversification is to minimize risk by ensuring that poor performance in one area does not significantly impact the overall portfolio. By combining investments with varying levels of risk and return, investors can achieve a more stable and predictable financial outcome.

Key Characteristics of a Diversified Portfolio

Here are some key characteristics that define a well-diversified fund portfolio:

- Asset Diversification: Includes a mix of stocks, bonds, real estate, commodities, and other asset classes.

- Sector Diversification: Spreads investments across industries such as technology, healthcare, finance, and consumer goods.

- Geographic Diversification: Allocates funds to both domestic and international markets to mitigate regional economic risks.

According to a study by Vanguard, portfolios with diversified assets tend to perform more consistently over time, offering better protection against market downturns.

The Importance of Diversification

Diversification is essential for any investor looking to achieve long-term financial success. By spreading investments across multiple asset classes, sectors, and geographies, you can reduce the impact of poor-performing investments on your overall portfolio. This approach not only minimizes risk but also enhances potential returns.

Benefits of Diversification

Here are some benefits of building a diversified fund portfolio:

- Reduced Risk: Diversification helps mitigate the risk of significant losses in case one investment performs poorly.

- Improved Stability: A diversified portfolio tends to be more stable, providing consistent returns over time.

- Enhanced Returns: By investing in a variety of asset classes, investors can take advantage of opportunities in different markets and sectors.

A report by BlackRock highlights that diversified portfolios tend to outperform concentrated portfolios during periods of market volatility.

Read also:Gabriella Salick The Rising Star In The Spotlight

Asset Allocation in Diversified Portfolios

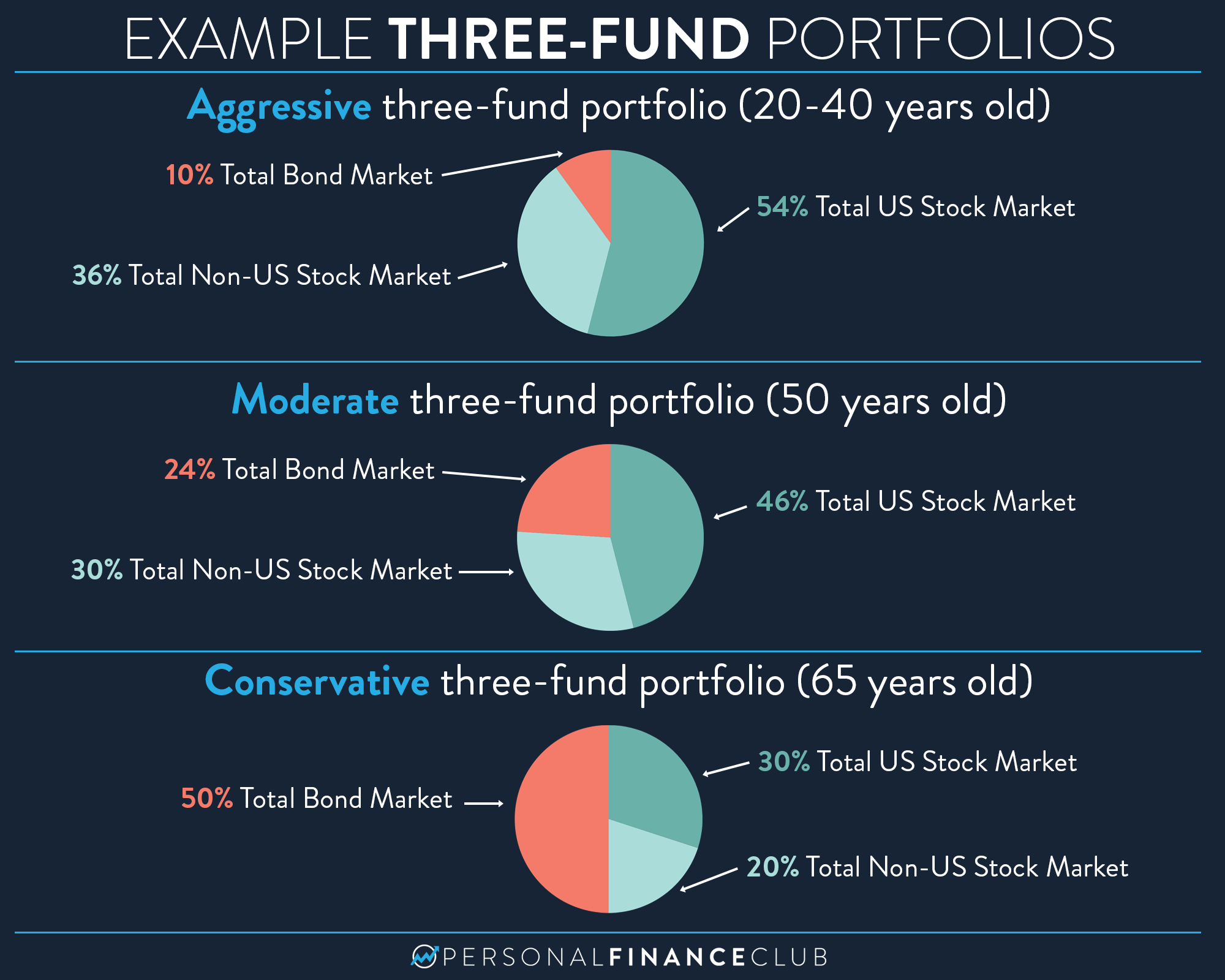

Asset allocation is the process of dividing your investment capital among various asset classes, such as stocks, bonds, and real estate. The right allocation depends on your financial goals, risk tolerance, and investment horizon. For example, younger investors may allocate a larger portion of their portfolio to equities, while those nearing retirement might prioritize fixed-income securities for stability.

Steps to Determine Asset Allocation

To determine the optimal asset allocation for your diversified fund portfolio, consider the following steps:

- Assess Your Financial Goals: Identify your short-term and long-term objectives.

- Evaluate Your Risk Tolerance: Determine how much risk you're willing to take to achieve your goals.

- Consider Your Investment Horizon: Longer time horizons allow for more aggressive allocations, while shorter horizons may require a more conservative approach.

Research from Morningstar suggests that asset allocation accounts for approximately 90% of a portfolio's performance, underscoring its importance in building a diversified fund portfolio.

Types of Funds to Include

When constructing a diversified fund portfolio, it's essential to include a variety of fund types to ensure broad exposure. Here are some common types of funds to consider:

Equity Funds

Equity funds invest primarily in stocks and offer the potential for high returns, though they come with higher risk. These funds can be further categorized by market capitalization (large-cap, mid-cap, small-cap) and geography (domestic, international).

Bond Funds

Bond funds invest in fixed-income securities, providing stability and income generation. They are generally less volatile than equity funds and can help balance a diversified portfolio.

Real Estate Investment Trusts (REITs)

REITs allow investors to gain exposure to the real estate market without directly owning property. These funds offer diversification benefits and can provide steady income through rental yields.

Steps to Build a Diversified Fund Portfolio

Building a diversified fund portfolio requires careful planning and execution. Follow these steps to create a portfolio that aligns with your financial goals:

Step 1: Define Your Investment Objectives

Clearly outline your financial goals, whether they are saving for retirement, funding education, or generating passive income. Your objectives will guide your investment decisions and asset allocation.

Step 2: Assess Your Risk Tolerance

Understand how much risk you're willing to accept in pursuit of higher returns. This assessment will influence the composition of your diversified fund portfolio.

Step 3: Choose the Right Funds

Select funds that align with your objectives and risk tolerance. Consider a mix of equity funds, bond funds, and alternative investments such as REITs or commodities.

Step 4: Monitor and Rebalance

Regularly review your portfolio's performance and rebalance as needed to maintain your desired asset allocation. Market conditions and personal circumstances may necessitate adjustments over time.

Risk Management Strategies

Effective risk management is crucial for maintaining a diversified fund portfolio. Here are some strategies to help mitigate risk:

1. Dollar-Cost Averaging

This strategy involves investing a fixed amount of money at regular intervals, regardless of market conditions. It helps reduce the impact of market volatility on your portfolio.

2. Stop-Loss Orders

Implement stop-loss orders to automatically sell investments if they fall below a certain price. This can protect your portfolio from significant losses during market downturns.

3. Regular Rebalancing

Periodically review and rebalance your portfolio to ensure it remains aligned with your asset allocation strategy. This helps maintain the desired level of risk and return.

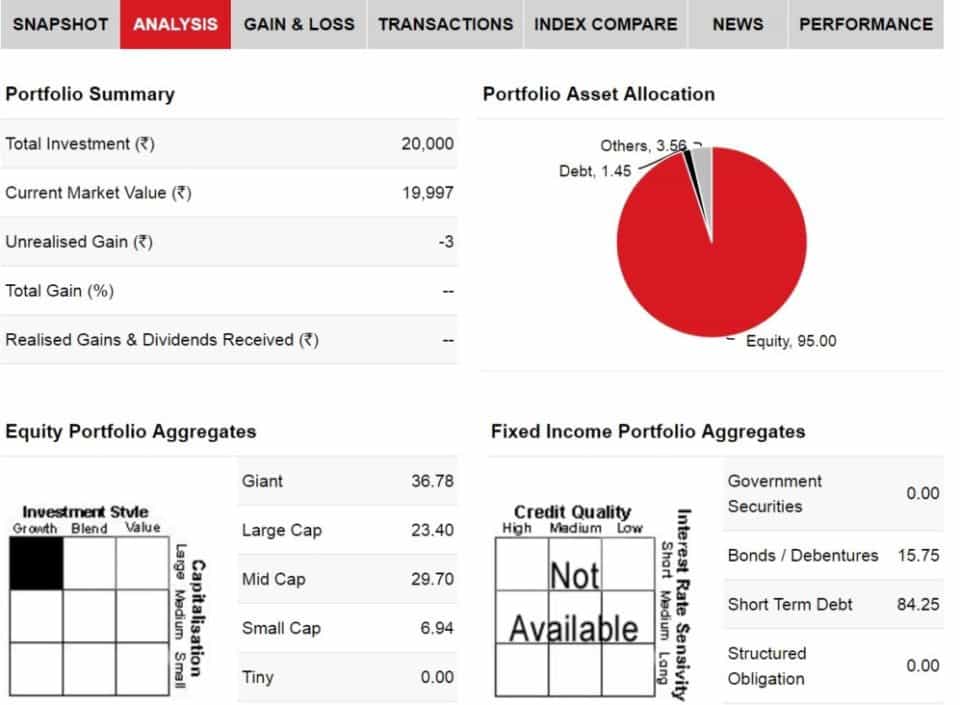

Measuring Portfolio Performance

Evaluating the performance of your diversified fund portfolio is essential for making informed investment decisions. Here are some key metrics to consider:

1. Rate of Return

Calculate the annualized rate of return to assess your portfolio's overall performance. Compare it to relevant benchmarks to gauge its effectiveness.

2. Risk-Adjusted Returns

Use metrics such as the Sharpe Ratio or Sortino Ratio to evaluate risk-adjusted returns. These measures help determine whether your portfolio's returns are justified by the level of risk taken.

3. Portfolio Volatility

Measure the volatility of your portfolio using standard deviation or beta. Lower volatility indicates a more stable portfolio, which is desirable for risk-averse investors.

Common Mistakes to Avoid

Building a diversified fund portfolio can be challenging, and investors often make mistakes that undermine their efforts. Here are some common pitfalls to avoid:

1. Overconcentration in a Single Asset

Placing too much emphasis on a single asset class or sector can expose your portfolio to unnecessary risk. Ensure broad diversification across multiple asset classes and sectors.

2. Neglecting Rebalancing

Failing to regularly rebalance your portfolio can lead to unintended risk exposure. Set a schedule for reviewing and adjusting your asset allocation as needed.

3. Ignoring Fees and Expenses

High fees and expenses can erode your portfolio's returns over time. Choose low-cost funds and be mindful of transaction costs when making investment decisions.

Expert Advice for Investors

To succeed in building a diversified fund portfolio, consider the following expert advice:

1. Stay Informed

Keep up with market trends and economic developments that may impact your investments. Regularly review financial news and consult with trusted advisors.

2. Maintain a Long-Term Perspective

Investing is a long-term endeavor, and short-term market fluctuations should not dictate your decisions. Focus on your financial goals and remain disciplined in your approach.

3. Seek Professional Guidance

Consider working with a financial advisor to develop a personalized investment strategy. Their expertise can help you navigate complex market conditions and optimize your portfolio.

Conclusion

Creating a diversified fund portfolio is a critical step toward achieving financial success. By spreading investments across various asset classes, sectors, and geographies, you can reduce risk while maximizing returns. This article has provided a comprehensive guide to building a diversified portfolio, including key principles, practical tips, and expert advice.

We encourage you to take action by evaluating your current portfolio and making necessary adjustments to align with your financial goals. Share your thoughts and experiences in the comments below, and explore other articles on our site for more investment insights. Remember, a well-diversified portfolio is your best defense against market uncertainties and your key to long-term prosperity.