In today's fast-paced digital world, ensuring the accuracy of financial transactions is more important than ever. The phrase "order check chase" has become increasingly relevant for individuals and businesses alike as they navigate the complexities of online payments, banking, and fraud prevention. Understanding the process of verifying and tracking your transactions can save you from potential financial losses and protect your sensitive information.

Whether you're dealing with online purchases, bank transfers, or credit card payments, the need to verify and track your transactions is crucial. This guide will delve into the importance of "order check chase," explain how to effectively monitor your transactions, and provide actionable tips to safeguard your financial data.

By the end of this article, you'll have a clear understanding of how to secure your financial transactions, identify potential fraud, and take proactive steps to protect your assets. Let's dive in and explore the world of "order check chase" in detail.

Read also:Gabriella Salick The Rising Star In The Spotlight

Table of Contents

- What is Order Check Chase?

- The Importance of Order Check Chase

- How to Perform an Order Check Chase

- Tools for Effective Order Check Chase

- Top Tips for Safe Financial Transactions

- Common Issues During Order Check Chase

- Legal Aspects of Order Check Chase

- Statistics on Financial Fraud

- Case Studies: Real-Life Examples

- The Future of Order Check Chase

- Conclusion

What is Order Check Chase?

The term "order check chase" refers to the process of verifying and tracking financial transactions to ensure accuracy and security. Whether you're dealing with an online purchase, bank transfer, or credit card payment, this process involves checking the details of your transaction to confirm that everything is in order.

In today's digital age, financial transactions are often conducted online, making it essential to verify and track your payments. This process helps you identify any discrepancies or potential fraud, ensuring that your financial data remains secure.

Why is Order Check Chase Necessary?

Order check chase is necessary for several reasons:

- It helps you identify potential fraud or unauthorized transactions.

- It ensures the accuracy of your financial records.

- It provides peace of mind by confirming that your transactions are secure.

The Importance of Order Check Chase

Verifying and tracking your financial transactions is crucial for maintaining the integrity of your financial data. In an era where cybercrime and financial fraud are on the rise, taking proactive steps to secure your transactions is essential.

According to a report by Javelin Strategy & Research, identity fraud affected 4.1 million consumers in the United States in 2021 alone. This highlights the importance of implementing robust security measures to protect your financial information.

Key Benefits of Order Check Chase

Some of the key benefits of performing an order check chase include:

Read also:Luca Dotti The Rising Star In The World Of Arts And Entertainment

- Early detection of fraudulent activity.

- Improved accuracy of financial records.

- Enhanced security of sensitive information.

How to Perform an Order Check Chase

Performing an order check chase involves several steps to ensure the accuracy and security of your financial transactions. Here's a step-by-step guide to help you get started:

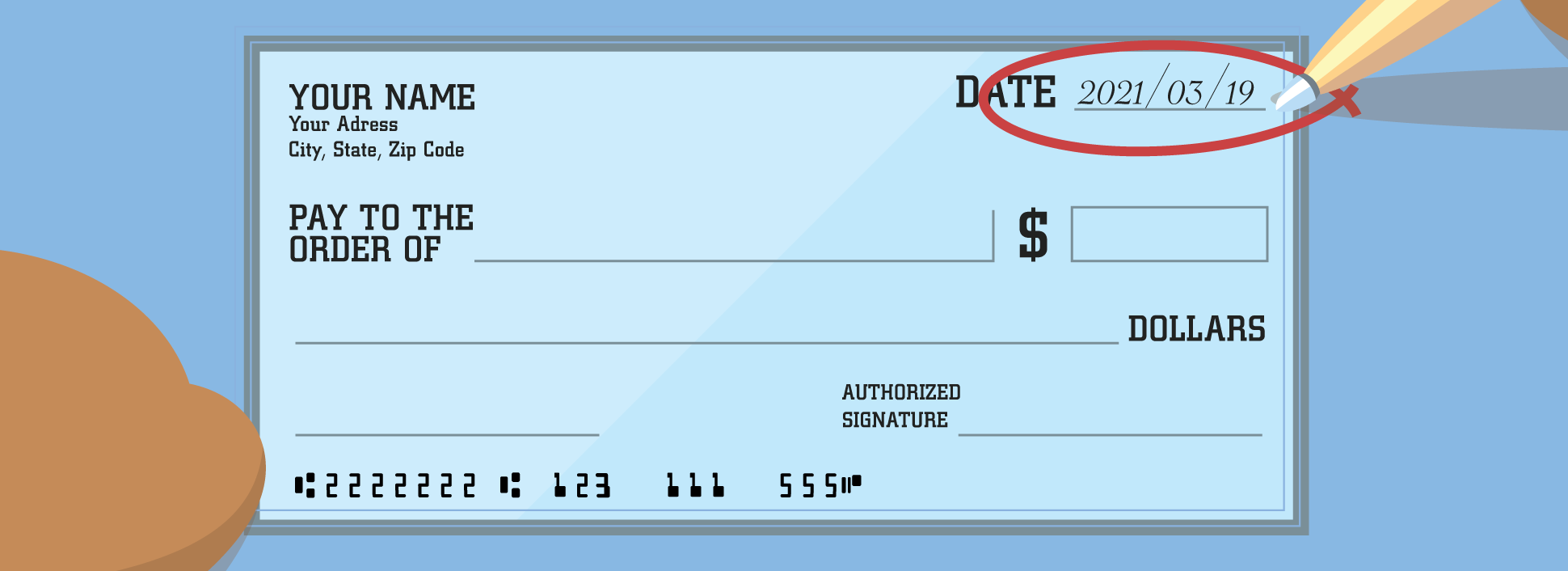

Step 1: Review Your Transaction Details

Begin by reviewing the details of your transaction. This includes checking the amount, date, and recipient of the payment. Ensure that all the information matches your expectations.

Step 2: Check Your Bank Statements

Regularly review your bank statements to identify any discrepancies or unauthorized transactions. Most banks offer online access to your statements, making it easy to monitor your financial activity.

Step 3: Contact Your Bank or Payment Provider

If you notice any suspicious activity, contact your bank or payment provider immediately. They can help you investigate the issue and take appropriate action to protect your account.

Tools for Effective Order Check Chase

Several tools and resources are available to help you perform an effective order check chase. These include:

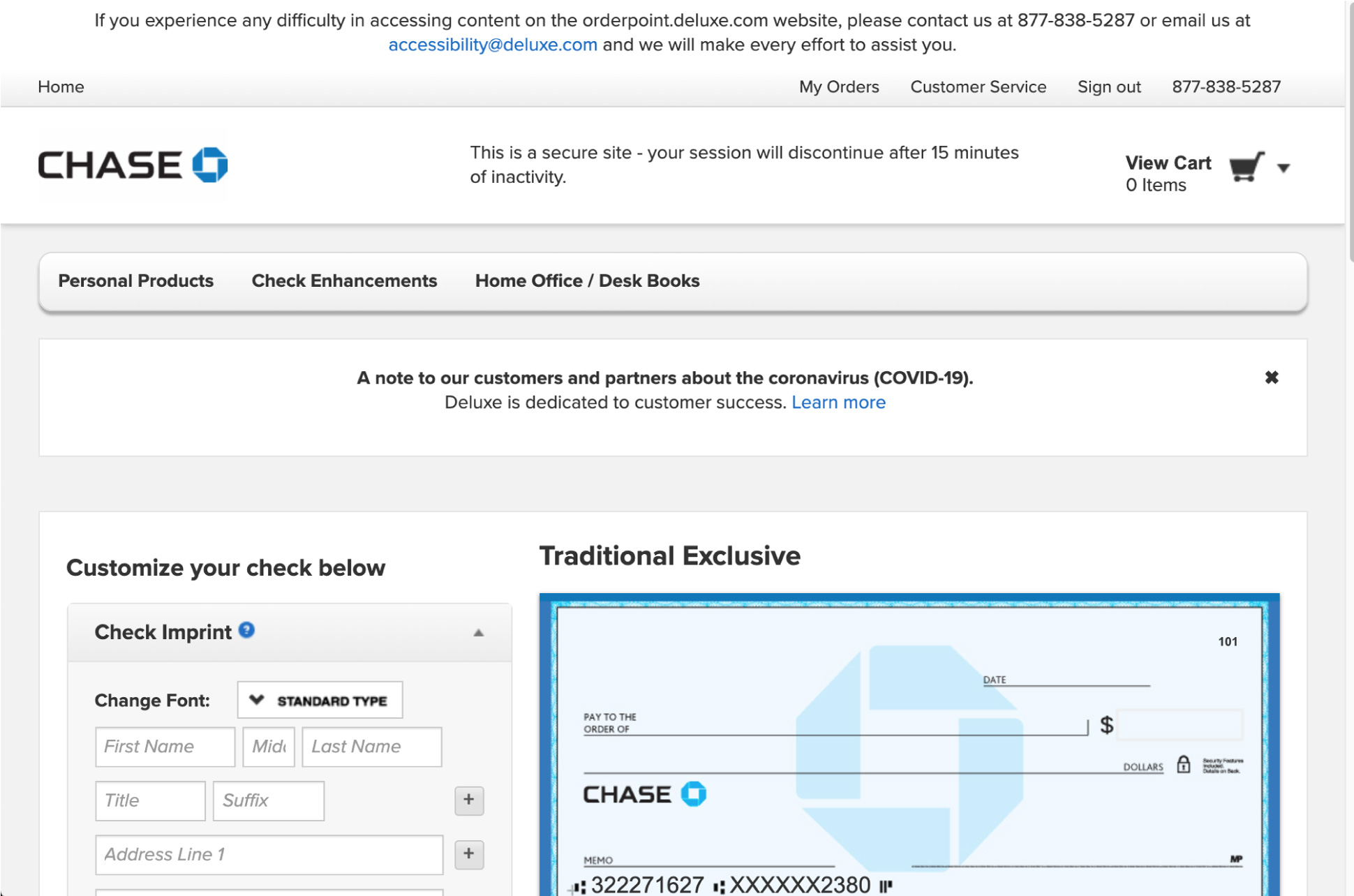

1. Online Banking Platforms

Most banks offer online banking platforms that allow you to monitor your transactions in real-time. These platforms often include features such as transaction alerts and fraud detection.

2. Financial Management Apps

Financial management apps like Mint, YNAB, and PocketGuard can help you track your expenses and identify potential issues with your transactions.

3. Credit Monitoring Services

Credit monitoring services like Experian and TransUnion provide alerts for any changes to your credit report, helping you detect potential fraud early.

Top Tips for Safe Financial Transactions

Here are some top tips to ensure your financial transactions are safe and secure:

- Use strong, unique passwords for your online accounts.

- Enable two-factor authentication for added security.

- Monitor your accounts regularly for any suspicious activity.

- Be cautious when entering your financial information online.

Common Issues During Order Check Chase

While performing an order check chase, you may encounter several common issues. These include:

1. Discrepancies in Transaction Details

Ensure that the details of your transaction match the information provided by the merchant or service provider. Any discrepancies should be reported immediately.

2. Unauthorized Transactions

If you notice any unauthorized transactions, contact your bank or payment provider right away. They can help you investigate the issue and take steps to protect your account.

3. Delayed Payments

Delayed payments can be frustrating, but they are often due to processing times or hold periods. Contact the merchant or service provider for clarification if necessary.

Legal Aspects of Order Check Chase

Understanding the legal aspects of order check chase is essential for protecting your rights as a consumer. In many countries, laws such as the Truth in Lending Act and the Electronic Fund Transfer Act provide protections for consumers against fraudulent transactions.

Consumer Protections

Consumer protections vary by country, but most include provisions for disputing fraudulent transactions and recovering lost funds. Be sure to familiarize yourself with the laws in your jurisdiction to ensure your rights are protected.

Statistics on Financial Fraud

Financial fraud is a growing concern worldwide, with millions of consumers affected each year. Here are some key statistics to consider:

- In 2021, identity fraud affected 4.1 million consumers in the United States.

- Credit card fraud accounted for 32% of all identity fraud cases in 2021.

- Phishing scams resulted in losses of over $54 million in 2021.

Case Studies: Real-Life Examples

Examining real-life examples of order check chase can provide valuable insights into the importance of this process. Here are two case studies to consider:

Case Study 1: Identifying Fraudulent Activity

John noticed an unauthorized transaction on his bank statement and immediately reported it to his bank. Thanks to his quick action, the bank was able to freeze his account and investigate the issue, ultimately recovering the lost funds.

Case Study 2: Preventing Identity Theft

Sarah regularly monitored her credit report and noticed a suspicious inquiry. She contacted the credit bureau and discovered that someone had attempted to open a new account in her name. By acting quickly, Sarah was able to prevent further damage and protect her identity.

The Future of Order Check Chase

As technology continues to evolve, the future of order check chase looks promising. Innovations such as blockchain, artificial intelligence, and biometric authentication are expected to enhance the security and accuracy of financial transactions.

These advancements will make it easier for consumers to verify and track their transactions, reducing the risk of fraud and unauthorized activity.

Conclusion

In conclusion, performing an order check chase is essential for ensuring the accuracy and security of your financial transactions. By understanding the process, utilizing the right tools, and following best practices, you can protect your assets and prevent potential fraud.

We encourage you to take action by monitoring your accounts regularly, reporting any suspicious activity, and staying informed about the latest developments in financial security. Share this article with your friends and family to help them stay safe, and don't hesitate to leave a comment or question below. Together, we can create a safer financial environment for everyone.