Jordan Belfort, the infamous stockbroker turned motivational speaker, gained notoriety for his involvement in illegal activities that rocked the financial world. His story is one of greed, deception, and the consequences of unchecked ambition. Understanding what exactly Jordan Belfort did that was illegal is essential to grasp the impact of his actions on both the financial industry and society as a whole.

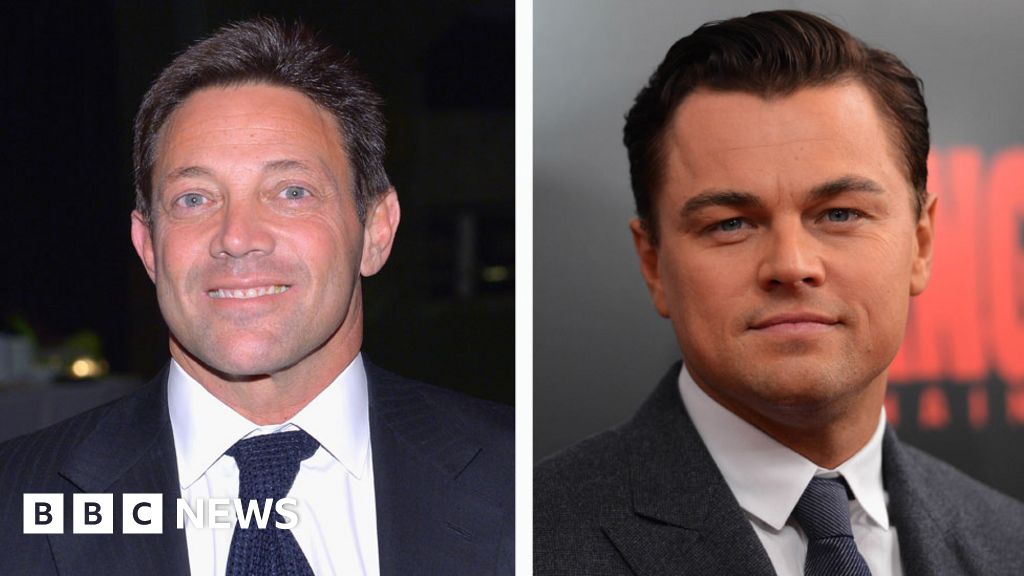

Belfort's rise to fame was marked by his audacious schemes and unscrupulous business practices. While his life has been immortalized in the movie "The Wolf of Wall Street," the reality of his illegal activities is far more complex and troubling than the Hollywood portrayal. This article aims to dissect the nature of his offenses and their long-term implications.

By exploring the legal violations committed by Jordan Belfort, we can gain a deeper understanding of the ethical boundaries in finance and the importance of accountability. This article will delve into his biography, the specific illegal activities he engaged in, and the lessons we can learn from his story.

Read also:Is Malik Yoba Married Exploring The Personal Life Of The Renowned Actor

Table of Contents

- Biography of Jordan Belfort

- What Did Jordan Belfort Do That Was Illegal?

- Ponzi Schemes and Pump-and-Dump Tactics

- Money Laundering Operations

- Legal Consequences for Jordan Belfort

- Impact on the Financial Industry

- Rehabilitation and Redemption

- Lessons Learned from Jordan Belfort's Story

- Criticism and Controversies Surrounding Jordan Belfort

- Conclusion

Biography of Jordan Belfort

Jordan Belfort was born on July 9, 1961, in Queens, New York. His early life was relatively ordinary, but his ambition and drive propelled him into the world of finance. Below is a summary of his personal and professional life:

Personal Information

| Full Name | Jordan Michael Belfort |

|---|---|

| Date of Birth | July 9, 1961 |

| Place of Birth | Queens, New York |

| Profession | Former Stockbroker, Author, Motivational Speaker |

| Notable Works | "The Wolf of Wall Street," "Way of the Wolf" |

Belfort's career in finance began in the late 1980s when he started working as a stockbroker. His charisma and salesmanship quickly earned him a reputation as a high-achiever in the industry.

What Did Jordan Belfort Do That Was Illegal?

Jordan Belfort's illegal activities primarily revolved around securities fraud, money laundering, and other unethical business practices. His actions were not only morally questionable but also legally prohibited, leading to severe consequences.

Types of Illegal Activities

- Manipulating stock prices through pump-and-dump schemes.

- Engaging in insider trading and securities fraud.

- Participating in money laundering operations to conceal illicit gains.

- Bribery and corruption involving government officials and business partners.

These activities were carried out through his brokerage firm, Stratton Oakmont, which became a hub for unethical practices during the 1990s.

Ponzi Schemes and Pump-and-Dump Tactics

One of the most infamous aspects of Jordan Belfort's illegal activities was his involvement in Ponzi schemes and pump-and-dump tactics. These schemes involved artificially inflating stock prices by spreading misleading information and then selling the inflated stocks for profit.

How Pump-and-Dump Schemes Work

According to the Securities and Exchange Commission (SEC), pump-and-dump schemes typically involve the following steps:

Read also:Rick Aviles The Untold Story Of A Visionary In The Tech World

- Identifying undervalued or penny stocks.

- Spreading false or exaggerated information to attract investors.

- Quickly selling the inflated stocks at a profit while the prices are high.

Belfort's brokerage firm, Stratton Oakmont, became notorious for employing these tactics on a massive scale, defrauding thousands of investors and causing significant financial losses.

Money Laundering Operations

In addition to securities fraud, Jordan Belfort was also involved in money laundering activities. Money laundering refers to the process of disguising the origins of illegally obtained money to make it appear legitimate.

Methods Used for Money Laundering

Some of the methods employed by Belfort and his associates included:

- Setting up offshore accounts to hide illegal profits.

- Using shell companies to transfer funds across borders.

- Investing illicit gains into luxury assets such as yachts and real estate.

These operations were complex and involved a network of accomplices, making it difficult for authorities to trace the illegal activities.

Legal Consequences for Jordan Belfort

Jordan Belfort's illegal activities eventually caught up with him, leading to a series of legal consequences. In 1999, he pleaded guilty to securities fraud and money laundering, resulting in a 22-month prison sentence.

Key Legal Penalties

- 22-month federal prison sentence.

- Fines amounting to millions of dollars in restitution to victims.

- Prohibition from working in the securities industry.

Belfort's legal troubles served as a wake-up call for the financial industry, highlighting the need for stricter regulations and oversight.

Impact on the Financial Industry

Jordan Belfort's illegal activities had a profound impact on the financial industry. The fallout from his schemes led to increased scrutiny of brokerage firms and the implementation of stricter regulations to prevent similar offenses in the future.

Regulatory Changes Post-Belfort

Some of the regulatory changes that followed include:

- Enhanced monitoring of penny stock transactions.

- Stricter disclosure requirements for brokerage firms.

- Increased penalties for securities fraud and insider trading.

These measures were aimed at restoring public trust in the financial markets and ensuring greater transparency in business practices.

Rehabilitation and Redemption

After serving his prison sentence, Jordan Belfort embarked on a journey of rehabilitation and redemption. He transformed himself into a motivational speaker and author, sharing his experiences and insights with audiences worldwide.

Key Themes in Belfort's Redemption

- Learning from past mistakes and promoting ethical business practices.

- Sharing strategies for sales and leadership through his books and seminars.

- Encouraging accountability and integrity in corporate environments.

Belfort's transformation has been met with mixed reactions, with some praising his efforts while others remain skeptical of his sincerity.

Lessons Learned from Jordan Belfort's Story

The story of Jordan Belfort serves as a cautionary tale about the dangers of unchecked ambition and unethical behavior in the financial world. Key lessons include:

Key Takeaways

- The importance of ethical conduct in business and finance.

- The consequences of greed and deception on individuals and society.

- The need for robust regulations and oversight to prevent fraud.

By examining Belfort's story, we can better understand the importance of integrity and accountability in the financial industry.

Criticism and Controversies Surrounding Jordan Belfort

Despite his efforts at redemption, Jordan Belfort remains a controversial figure. Critics argue that his portrayal of his illegal activities in books and movies glorifies his past misdeeds rather than condemning them.

Common Criticisms

- Glorification of illegal activities in media representations.

- Concerns about the ethical implications of profiting from past crimes.

- Skepticism about the authenticity of his redemption narrative.

While Belfort's story has captivated audiences worldwide, it also raises important questions about the role of ethics in public discourse.

Conclusion

Jordan Belfort's story is a powerful reminder of the dangers of unethical behavior in the financial world. By exploring what he did that was illegal, we gain valuable insights into the importance of integrity, accountability, and transparency in business.

In conclusion, the illegal activities of Jordan Belfort had far-reaching consequences, both for the victims of his schemes and the financial industry as a whole. His journey from convicted criminal to motivational speaker offers a unique perspective on the potential for redemption and the lessons we can learn from past mistakes.

We invite you to share your thoughts and reflections on this article in the comments section below. Additionally, feel free to explore other articles on our site for more insights into finance, ethics, and personal growth.